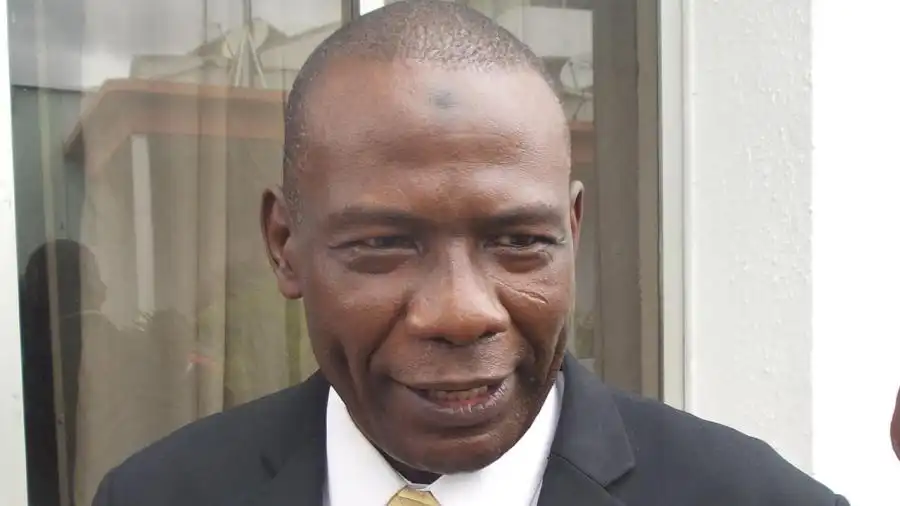

Aminu Gwadabe

The nation’s bureau de change operators have renewed agitations over their assessed unfavourable terms of transactions with the Central Bank of Nigeria (CBN) and banks.For the most part of 2017, the group, while expressing gratitude for regulatory shifts, had complained that their support for exchange rate stability, which is now converging, resulted in less income for them due to transactional costs.

President of the Association of Bureaux De Change Operators of Nigeria (ABCON), Alhaji Aminu Gwadabe, said his members will continue find ways to get the CBN reduce rising bank charges associated with their transactions.

“BDCs are charged N1,000 per million naira transaction, costing each operator as much as N67,000 for the N67 million monthly transactions. These charges are too high,” he stated Gwadabe affirmed that the challenges faced by BDCs are enormous, as many forex users now prefer to buy their allowances, medical bills and school fees payment abroad from banks instead of BDCs due to the converging rates at parallel market and BDCs.

“The exchange rate at both parallel market and BDCs closed last weekend at N361/$,” he said, adding that the development triggered massive flight of forex users from the mandatory regulatory documentations sought by BDCs to parallel market.

“Many forex users prefer to buy at the parallel market instead of BDCs because there are no longer rate gaps. They prefer the parallel market where there is no single documentation required. That is why we are calling on the CBN to review the rate band for BDCs,” he stated.

As stated by him, the challenges, if not checked, would trigger a liquidity crisis that may derail the ongoing recovery of the naira against the dollar.“We want the CBN to review the BDC rate to ensure that currency speculators do not return to the market. Remember the BDCs buy dollar at N360/$1 from the International Money Transfer Operators (IMTOs),” he stated.

To this end, the group has called for an emergency meeting of its members to discuss critical issues in the foreign exchange (forex) market tomorrow at the Gloval Hall, Lagos,Top on the agenda include call for convergence of BDC and banks’ rates; fight prevalence of un-registered forex operators; and the rising bank charges associated with BDCs’ transactions.

The meeting, which holds on Wednesday, January 10 at Gloval Hall, Lagos, at 10.00am prompt, will be attended by over 3,500 Central Bank of Nigeria (CBN)-licenced BDCs and members of ABCON.ABCON President, Alhaji Aminu Gwadabe, who disclosed this yesterday, said negative margins being experienced by BDCs,

Also to be discussed is the review of yearly license renewal; approval of additional forex disbursement centers in Port Harcourt, Maduguri, Benin, Ibadan; Company Income Tax and Value Added Tax payment by BDCs; among others.Gwadabe added that the meeting would equally enable members review and acquaint themselves with all the level of automations of operations; presentation of ABCON Logo for members’ corporate identity; and ABCON Estate.