Hong Kong stocks have plunged more than three per centthe biggest weekly drop since the depths of the global financial crisis in 2008, as tumult on Wall Street rips across Asia.

It follows Tuesday when Hong Kong fell more than five per cent before two relatively benign days of trade.

Global markets have this week been swept up in a wave of selling while investors fret about the impact of US interest rates tightening.

An investor watches the electronic board at a stock exchange hall in Hangzhou, China. Chinese and Hong Kong stocks plunged this week

Hong Kong's Hang Seng Index tumbled 3.1 per cent. For the week, Hang Seng dropped 9.5 per cent, the biggest weekly loss since October, 2008.

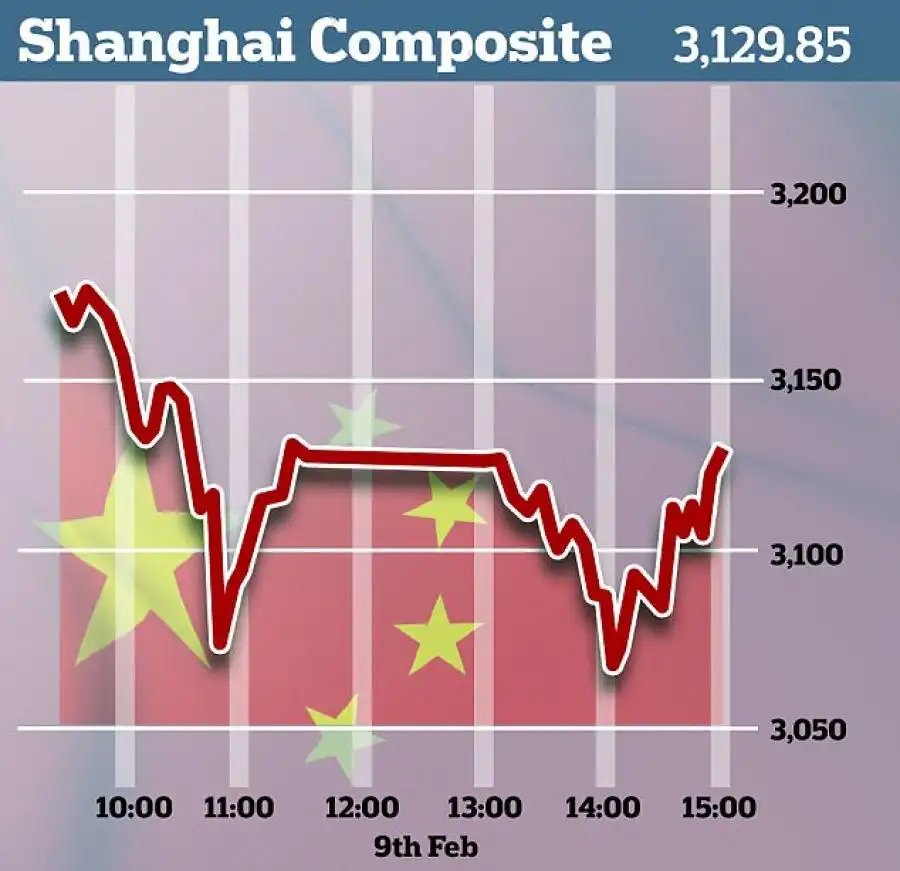

The benchmark Shanghai Composite Index fell 4.05 per cent, or 132.20 points, to 3,129.85 on turnover of 272.1 billion yuan ($43.1 billion). It lost 9.60 per cent over the week.

The Shenzhen Composite Index, which tracks stocks on China's second exchange, fell 3.19 per cent, or 55.31 points, to 1,679.26 on turnover of 222.1 billion yuan. It lost 7.81 per cent this week.

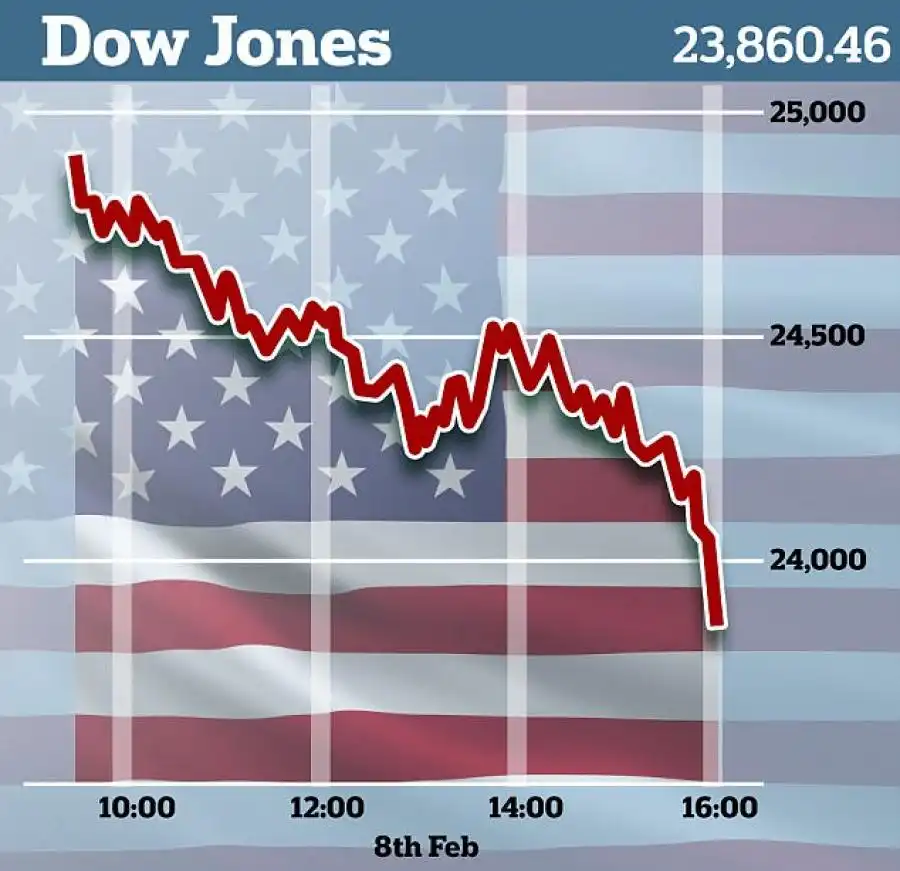

This came after Dow Jones plunged 1,000 points, bringing the index down 10 per cent from the record it reached two weeks ago. The tumult started last Friday as investors worried about signs of rising inflation.

The HSI has now lost all the gains it enjoyed over a stellar January, as the sell-off that has haunted markets across the globe returned.

Trading floors have been awash with red in February on fears that the booming global economy and rising inflation will lead to higher interest rates.

Friday's drop followed another Wall Street retreat with the Dow suffering its second-heaviest daily points fall on recordthe worst coming on Mondayafter key US Treasury bond yields spiked fuelling the likelihood of higher borrowing costs.

The week had started badly after last Friday's strong US jobs report that also showed rising US wage growth, increasing speculation the Federal Reserve will lift rates more than the three times already expected this year.

The Hang Seng dropped 9.5 per cent in a week, the biggest weekly loss since October, 2008

The benchmark Shanghai Composite Index lost 9.60 per cent over the week

Pedestrians walk past an electronic display that shows the Hang Seng Index in Hong Kong on Tuesday. Hong Kong registered its largest weekly drop since the financial crisis

Among the biggest losers Friday were energy firms, which have been shredded by a drop in oil pricesboth main contracts are around 10 per cent off their recent highs seen in January.

PetroChina led the selling, diving 3.41 per cent to HK$5.38 (US$0.69) while CNOOC plunged 2.96 per cent to HK$11.16 and Sinopec lost 2.72 per cent to HK$6.08.

Volatile casino operators tumbled with Galaxy Entertainment down 6.05 per cent at HK$62.90 and Wynn Macauwhich surged eight per cent Thursdaydown 4.44 per cent at HK$25.80.

Market heavyweight Tencent slumped 3.05 per cent to HK$407.40 and HSBC slipped 0.87 per cent to HK$79.80 while insurance giant AIA fell 4.28 per cent to HK$59.30.

The plunge in Shanghai has left the the market at its lowest point since last June.

'Chinese markets showed signs of a rebound from the previous day with better performance in technology and small stocks but the spillover effect from US stocks was too strong.' stated Zhang Yanbing, an analyst with Zheshang Securities.

'When Wall Street sneezes, global markets catch a cold.'

China's government, still smarting from a dizzying 2015 stock rise and crash, has taken increasing steps to steady the nation's often volatile share markets.

China's central bank stated Friday it had freed up liquidity worth about 2 trillion yuan to meet demand before the Chinese new year next week, an apparent attempt to ease fears about the recent falls.

'We are still in the depth of market volatility as sentiment was hurt by the double whammy of US market turmoil and deleveraging efforts at home,' Wu Kan, a Shanghai-based fund manager at Shanshan Finance, told Bloomberg News.

'Risk appetite has dropped sharply and I don't think the situation will get any better before the Chinese New Year holiday.'

Ping An Insurance dropped 6.61 per cent to 64.43 yuan and New China Life Insurance plunged 9.05 per cent to 51.63 yuan.

The Dow Jones plunged 1,000 points, bringing the index down 10 per cent from the record it reached two weeks ago

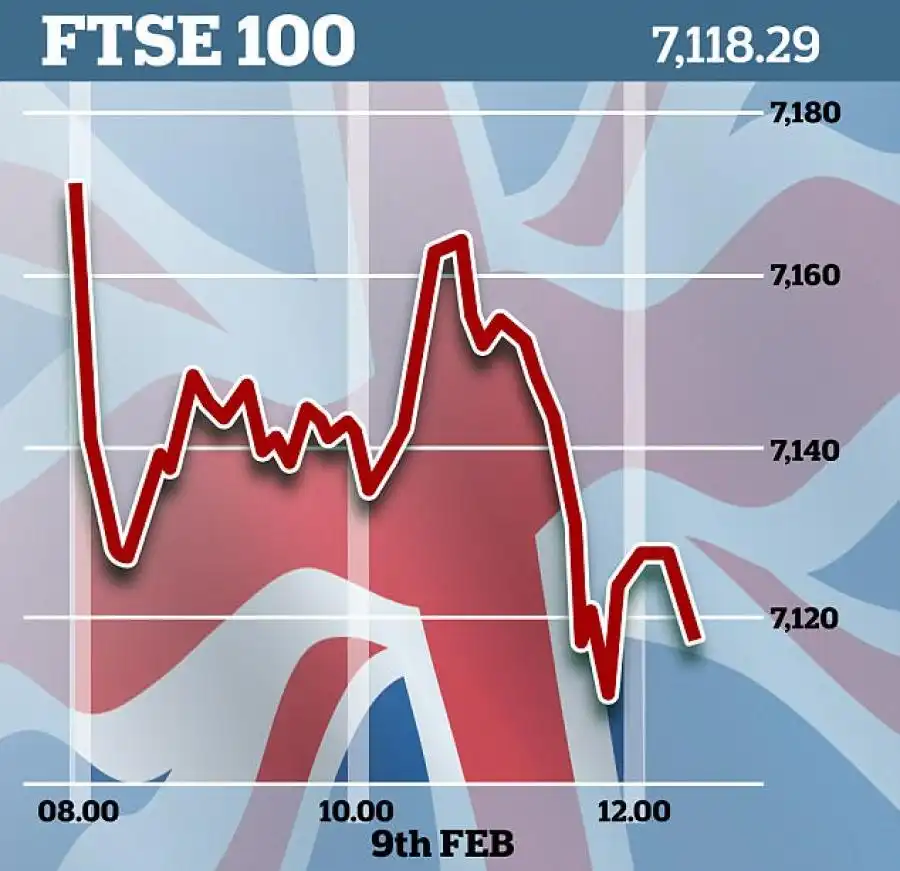

The FTSE 100 dropped but no as substantially as its American or Asian counterparts

In Frankfurt, the DAX 30 also suffered substantial loss

Trader Gregory Rowe works on the floor of the New York Stock Exchange, which watched as the Dow Jones lose as much as 1,000 this week

Banking giant ICBC dropped 2.05 per cent to 6.68 yuan and China Citic Bank plunged 4.83 per cent to 6.90 yuan.

'It's bulls killing bulls', stated hedge fund manager Gu Weiyong about the stampede out of stocks by once-bullish investors.

'If 10-year, risk-free rates keep climbing toward five per cent, stocks with earnings multiples of 30 or more will become increasingly expensive, so they're getting dumped by institutional investors,' stated Gu, Shanghai-based chief investment officer at Ucom Investment Co.

Chinese government bonds held steady. The price of the most-traded China 10-year treasury futures for March delivery was basically flat.

The yuan weakened against the dollar in thin volume, and the Chinese currency was on track for its first weekly loss in nine weeks.

European shares fared better, posting limited losses at the open today.

The Stoxx 600 share index fell 0.4 per cent by 8.23am GMT with all European bourses and sectors trading in negative territory.

It had already fallen 1.6 per cent on Thursday, with declines accelerating towards the end of the trading day.

'It would appear that the brief respite for stocks seen in the middle of the week turned out to be the eye of the storm as once again rising bond yields prompted a further bout of selling across the board, not only in the U.S. last night but in Asia again this morning', stated Michael Hewson, chief market analyst at CMC Markets.

Utilities stocks, which are expected to suffer as interest rates rise, were the worst performers and the sector's index fell one per cent.