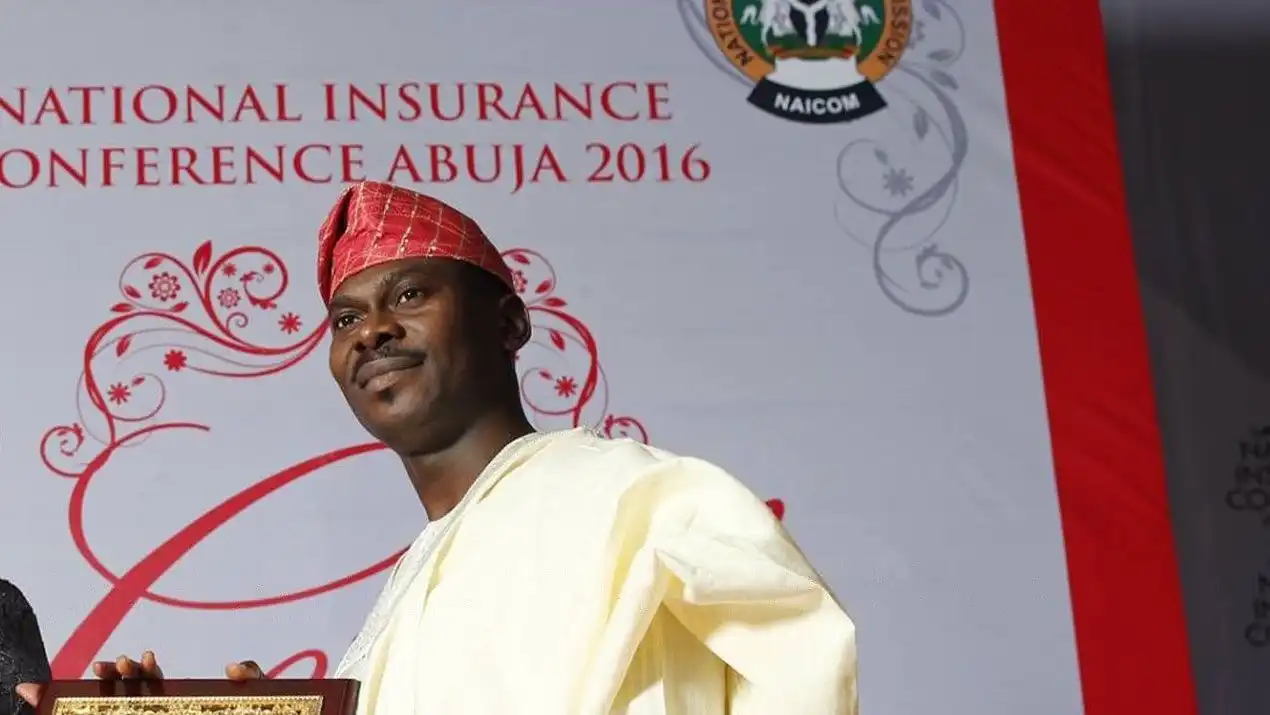

Olamerun Gbadebo

• ARIAN admits solely 7,000 are registered

The renewed marketing campaign to rev up public confidence in the troubled insurance sector could quantity to mere “dress rehearsal”, with no fewer than 13,000 fake insurance agents soliciting insurance policies in the midst of few registered ones.

With the only real intention of ripping off intending policyholders of their belongings in return for fake protection and alarming degree of discoveries that many automobile coverage certificates are fake, it's now time for the sector’s regulators and stakeholders to behave.

Specifically, out of the estimated 20,000 insurance agents working in the nation’s insurance business, solely about 7,000 are registered with the Association of Registered Insurance Agents of Nigeria (ARIAN).

This implies that the sector isn't solely underserved, with intending policyholders not being reached, but in addition a fertile floor and alternative for underhand dealings, as every of the unregistered agents can snap enormous enterprise and abscond.

Already, the insurers have expressed fear that the business is under-served with nearly few registered with ARIAN, whereas others are parading the sector with the intention of accumulating cash from potential policyholders.

As said by them, this may not be sufficient to make the sector obtain its set objectives, particularly in the continued re-branding mission launched into in the business.

They famous that the variety of agents in Nigerian insurance business is low in comparison with what obtains in different international locations, including that this shortfall is without doubt one of the elements undermining insurance penetration and development in the nation.

Speaking with The Guardian on the event, the previous President of ARIAN, Gbadebo Olamerun, affirmed that there are “about 20,000 agents servicing a shopping for inhabitants of insurance customers, however solely about 7,000 registered, whereas India has about 1.9 million agents, whereas South Africa has about 400,000 agents.

“I can tell you for a fact, that some individual companies do not have up to 200 agents. This is so because the funds that are meant to be invested in doing all of these things are not being applied to that.”

Speaking in the identical vein, Chairman of Nigerian Insurers Association (NIA), Eddie Efekoha, stated that in Hong Kong, there are over 25,000 agents servicing a whole inhabitants of simply 17 million folks.

“In Hong Kong, insurance contributes substantially to the GDP of the country. Over there they have over 25,000 insurance agents which greatly enhanced insurance penetration in that country. These are things that we should begin to implement in Nigeria,” he stated.

On why the Nigerian market has restricted agents, an business stakeholder, Mr. Salami, stated: “For too lengthy in the business, everybody centered on corporate enterprise. It was cheaper to run corporate insurance and simply be getting enterprise from the General public sector. But now, we see that we have to go approach past that, so a number of of us are making the required funding in distribution of insurance.

“We need to deliver value and good service to customers because they can also become our ambassador in getting other people to come and buy insurance because things are changing. The insurance industry of today, regarding claims is not the insurance industry of five years ago.”